Program to compare stock performance of Senator’s transactions vs when the sale is disclosed

Program to compare stock performance of Senator’s transactions vs when the sale is disclosed. Using to find if tracking Senator stock trades is a worthwhile investment strategy: it is.

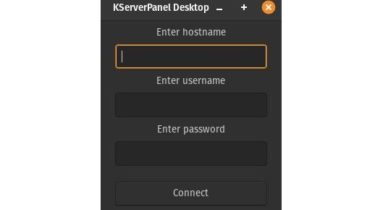

Calls SenateStockWatcher.com’s API to receive an aggregate list of Senator stock transactions. Then uses a for loop to cycle through the stock purchases and calls senator_performance and disclosure_performance functions to find buy prices and current prices of each to calculate performances.

Senators have a statistically significant overperformance of the market average (~6% yearly). Specific to this program, although Senators overperform vs their diclosure dates, tracking Senator stock purchases from their disclosure dates is a worthwhile investment strategy.

Cole Cestaro – University of Virginia, Class of 2025

This project is licensed under the MIT License.