Forecasting directional movements of stock-prices for intraday trading using LSTM and random-forest

Stock-market-forecasting

Forecasting directional movements of stock-prices for intraday trading using LSTM and random-forest

https://arxiv.org/abs/2004.10178

Pushpendu Ghosh, Ariel Neufeld, Jajati K Sahoo

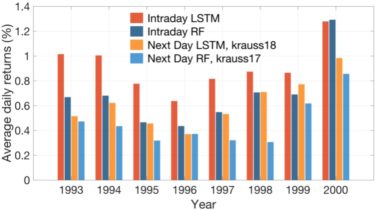

We design a highly profitable trading stratergy and employ random forests and LSTM networks (more precisely CuDNNLSTM) to analyze their effectiveness in forecasting out-of-sample directional movements of constituent stocks of the S&P 500, for intraday trading, from January 1993 till December 2018.

Bibtex

@article{ghosh2021forecasting,

title={Forecasting directional movements of stock prices for intraday trading using LSTM and random forests},

author={Ghosh, Pushpendu and Neufeld, Ariel and Sahoo, Jajati Keshari},

journal={Finance Research Letters},

pages={102280},

year={2021},

publisher={Elsevier}

}

Requirements

pip install scikit-learn==0.20.4

pip install tensorflow==1.14.0

Plots

We plot three important metrics to quantify the effectiveness of our model: Intraday-240,3-LSTM.py and Intraday-240,3-RF.py, in the period January 1993